Your Income Tax Return: Guide for the Year 2024-25

Every Year it’s the same story- How to file my Income Tax return? Which exemptions and deductions are applicable to me? Should I take the help of someone professional? But he’ll charge heavy fees……

The Income Tax Act provides taxpayers with the option of selecting from two tax regimes- the Old Tax Regime and the New Tax Regime (Default). In the new tax regime the tax rates are lower but tax payers can avail fewer deductions. Since the new tax regime is default, the tax payers can choose to pay tax under old tax regime by filing Form 10-IEA before the due date of filing their income tax return, otherwise they will be taxed under the new tax regime. So, a tax payer having fewer ductions can avail the benefit of Filing under the New Tax Regime. If you are a non-salaries tax payer you cannot opt in and opt out of new regime every year, they cannot opt in again for the new tax regime in the future.

Filing Income Tax Returns in India is compulsory if your income is more than the exemption limit and if you don’t file the return interest and late fees will be charged. But understanding of which documents are required, which ITR Form is applicable and how to claim refund is very confusing and it is not possible for a layman to understand everything about Income Tax, So Here’s the complete Guide:

Do I Really Need to File an ITR? Here’s How to Know

Under Old Tax Regime

An Individual or HUF having an income of Rs. 2,50,000 is not required to pay any income tax.

Wait, there’s a catch-What’s Your Age?

If your age is 60 Years or more the basic exemption limit for you is Rs.3,00,000, and,

If your age is 80 Years or more the basic exemption limit for you is Rs.5,00,000

Under New Tax Regime

An individual is not required to pay tax if his/her income is up to Rs.3,00,000

A rebate of Rs.25,000 is allowed for income within Rs.7,00,000 under the new tax regime and Rs.12,500 is allowed under the old tax regime

So, you are not required to pay any Income Tax if your Income is below or up to the basic exemption limit.

Pre- Filing Checklist

- PAN

- Aadhar Number

- All the bank account details

- TDS Certificates like Form 16, Form 16A, 26AS, AIS.

- Tax Payment Challans

- Investment Proofs for Investment made

- Income From House Property:

- Rental Income Details

- Interest Certificate for Loan including Pre-Construction Interest

- Receipts of Municipal Taxes Paid

- Capital Gains:

- In case of Sale of Immovable Property:

- Sale and Purchase Deed including cost of Improvement details and transfer Expenses

- Details of Buyer including PAN and Aadhar

- Sale of Equity Shares and Mutual Funds:

- Capital Gain Statement from your Broker

- Any Other Income:

- Bank Statement or Interest Certificate for Interest Income

- Interest Income Certificate for Fixed Deposits

Here’s a list of Deductions which might be applicable to you:

Sec. 80C – Investment in PF, NSC, Tuition fees paid for education up to 2 Children), House Loan Principal Repayment, ULIP, Pension Scheme of UTI or MF, Sukanya Samriddhi Yojna, Stamp Duty and Registration fee for Property Acquisition (Maximum: Rs.1,50,000). This deduction is not available in the New Regime.

Sec 80D- Medical Insurance Premium for self, spouse, parents and dependent children; medical expenses incurred for senior citizens; preventive health checkup, a deduction ranging from Rs.25,000 to Rs.1,00,000 can be claimed depending on the age of the individual and the parents. This deduction is not available in the New Regime.

Sec. 80E- Interest amount for a period of 8 years starting from the year in which the Individual starts paying can be claimed as deduction for loan taken for Higher Education in India or Abroad. This deduction is not available in the New Regime.

Sec. 80TTA: Interest on savings account is eligible for deduction for a maximum limit of Rs.10,000. This deduction is not available in the New Regime.

Sec.80TTB: For Senior Citizens, interest on deposits from banks is eligible for deduction up to a maximum limit of Rs.50,000. This deduction is not available in the New Regime.

If you are a salaried employee a standard deduction of Rs.50,000 is allowed under the old regime on the other hand a standard deduction of Rs.75,000 is allowed under the New Tax Regime. Also, the HRA, Leave Travel Allowance and Professional Tax Deduction is not available in the new regime.

Interest on Home Loan on Let Out Property (Sec.24) is allowed in the new regime.

Are You an Individual Professional or a Small Business, want to opt for 44AD or 44ADA?

Section 44AD is a provision under the Indian Income Tax Act that offers a presumptive taxation scheme for small businesses. It’s designed to simplify tax compliance for individuals, Hindu Undivided Families (HUFs), and partnership firms (excluding LLPs) with a turnover of up to ₹2 crore—or ₹3 crore if cash receipts are within 5% of total turnover.

Here’s how it works:

- You declare income at 8% of turnover (or 6% if receipts are digital).

- You’re not required to maintain detailed books of accounts.

- You can file your return using the simpler ITR-4 form.

- You must pay 100% advance tax by March 15 of the financial year.

Section 44ADA of the Income Tax Act is a presumptive taxation scheme designed to simplify tax filing for self-employed professionals in India. Instead of maintaining detailed books of accounts, eligible taxpayers can declare a fixed percentage of their gross receipts as income

Who can opt: Individuals and partnership firms (excluding LLPs) engaged in specified professions like legal, medical, engineering, architecture, accountancy, technical consultancy, interior decoration, etc.

Turnover limit: Gross receipts should not exceed ₹75 lakh in a financial year, provided at least 95% of receipts are through digital or banking channels.

Presumptive income: 50% of gross receipts are deemed as income. No further deductions for expenses are allowed.

No need to maintain books: If you opt for 44ADA, you’re not required to maintain detailed books of accounts or get them audited.

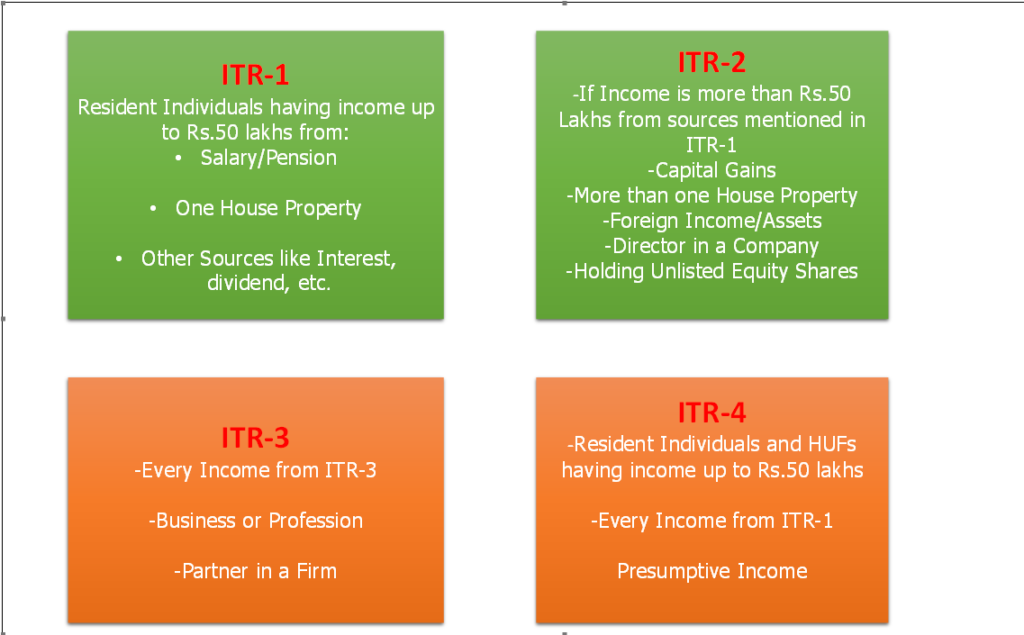

Choosing the Right ITR Form:

Not sure which ITR form to pick? You’re not alone—choosing the right one can feel a bit overwhelming.

Here’s is the complete Guide for You:

Common Mistakes to Avoid:

Here are some common Mistakes that may be made by you filing your Return:

- Selecting the Incorrect ITR Form

- Furnishing Incorrect Personal Information

- Failure to Disclose all the Sources of Income

- Failure to Reconcile TDS Details with Form 26 AS

- Failure to reconcile Income and Investments with AIS

- Failed to Obtain Form 16 from Employer

- Not Availing the Deductions applicable to you

- Not Paying Advance Tax

- Failed to E-Verify ITR on Time

The above list is inclusive not exclusive, there are many mistakes that are made by the Taxpayers and should be avoided with the help of experts.

Hey Readers,

Filing your Income Tax Return might seem straightforward—until it’s not. From choosing the right ITR form to avoiding common mistakes that could delay your refund or trigger a notice, the process can get tricky fast.

That’s where we come in.

✅ Personalized Guidance – We don’t just file your return; we understand your income sources, deductions, and financial goals to ensure maximum accuracy and savings.

✅ Time-Saving – No more second-guessing forms or chasing documents. Our experts handle the heavy lifting while you focus on what matters most.

✅ Error-Free Filing – With our experience and tools, we minimize the risk of errors that could lead to penalties or scrutiny.

✅ Post-Filing Support – Need help with e-verification, refund tracking, or responding to a notice? We’ve got your back even after your return is filed.

Let us take the stress out of tax season—so you can file with confidence, not confusion.