Our Income Tax Services

Expert Income Tax Solutions Tailored for You

INCOME TAX

At Filers & Co., we understand that navigating the complexities of income tax can be overwhelming. Our team of experienced tax professionals is here to provide you with comprehensive income tax services designed to meet your unique needs. Whether you are an individual taxpayer or a business entity, we are committed to ensuring compliance while maximizing your tax benefits

Income Tax Return Filing by Experts

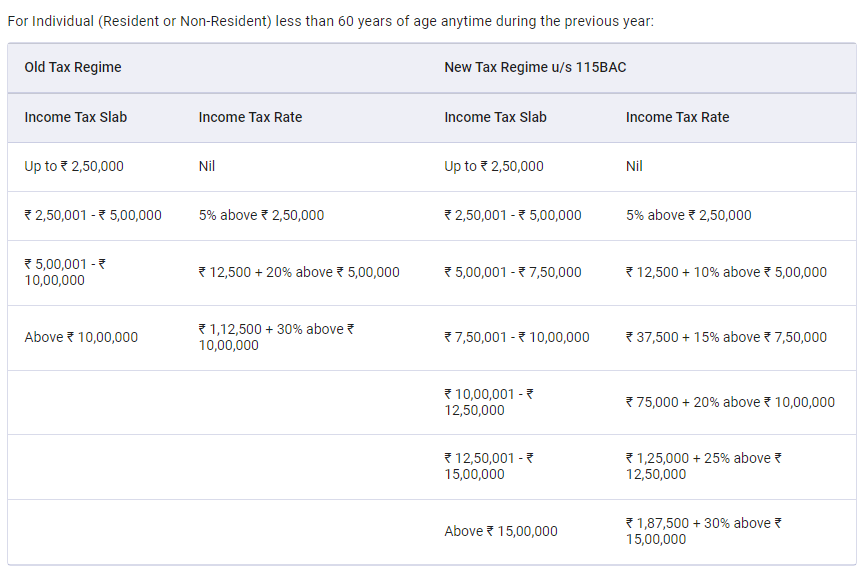

Our skilled tax professionals will handle your income tax return filing with precision and care. We ensure that all necessary documentation is accurately prepared and submitted on time, minimizing the risk of errors and penalties

- Peace of mind knowing your returns are filed correctly.

- Maximization of deductions and credits to reduce your tax liability.

- Timely filing to avoid late fees and interest charges.

Assistance in Tax Audits

Facing a tax audit can be daunting. Our team provides expert assistance throughout the audit process, from preparation to representation. We will help you gather the necessary documentation and communicate effectively with tax authoritie

- Expert guidance to navigate the audit process smoothly.

- Representation to protect your interests during the audit.

- Strategies to resolve any issues that may arise.

Tax Litigations

If you find yourself in a dispute with tax authorities, our experienced legal team is here to assist you. We provide representation in tax litigation cases, ensuring your rights are protected and advocating for a favourable outcome.

- Professional representation in tax disputes.

- Comprehensive understanding of tax laws and regulations.

- Focused strategies to achieve the best possible resolution.

Claims and Appeals

Our experts can help you file claims for refunds or appeal decisions made by tax authorities. We will work diligently to ensure that your claims are well-supported and presented effectively.

- Increased chances of successful claims and appeals.

- Thorough analysis of your tax situation to identify potential claims.

- Ongoing support throughout the claims and appeals process.

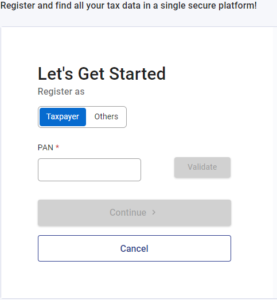

Register

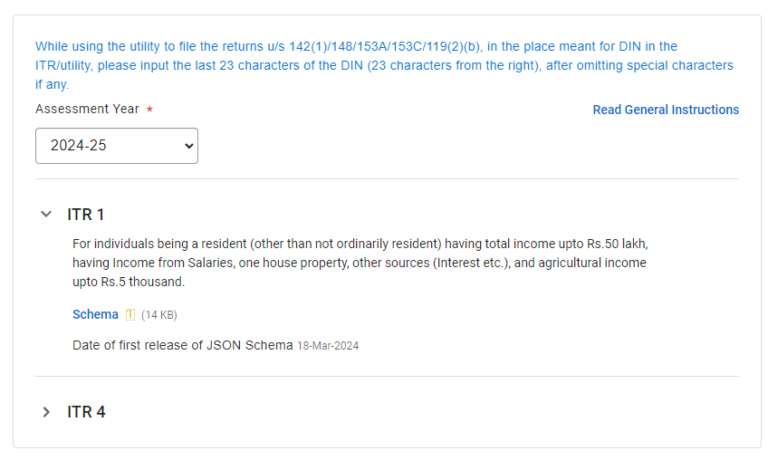

Downloaded ITR certificate

Why Choose Filers & Co.?

Our team consists of certified tax experts with extensive knowledge of income tax laws and regulations

We take the time to understand your unique tax situation and tailor our services accordingly.

We pride ourselves on delivering high-quality service and achieving the best outcomes for our clients

We offer competitive pricing with no hidden fees, ensuring you know exactly what to expect

Get Started Today!

Request A Quote

Don’t let tax season stress you out. Let the experts at Filers & Co. handle your income tax needs with professionalism and care. Contact us today to schedule a consultation!