Goods and Services Tax

GST SERVICES

Navigating the complexities of Goods and Services Tax (GST) can be challenging for businesses of all sizes. At Filers & Co., we offer comprehensive GST services designed to simplify compliance, optimize tax liabilities, and ensure that your business adheres to the latest regulations. Our team of experienced professionals is dedicated to providing tailored solutions that meet your unique needs

Our GST Services

GST Registration

Starting a new business or expanding your existing operations? We assist you with the GST registration process, ensuring that you meet all legal requirements and deadlines. Our experts will guide you through the documentation and application process, making it seamless and hassle-free

GST Compliance and Filing

Stay compliant with GST regulations with our end-to-end compliance services. We handle the preparation and filing of your GST returns, ensuring accuracy and timeliness. Our team keeps abreast of the latest changes in GST laws, so you can focus on running your business

GST Advisory Services

Our GST advisory services provide you with strategic insights to optimize your tax position. We analyse your business operations and transactions to identify potential savings and ensure compliance with GST regulations. Whether you need advice on input tax credits, exemptions, or cross-border transactions, we are here to help.

GST Audit Support

Prepare for GST audits with confidence. Our team offers comprehensive support during GST audits, helping you gather necessary documentation, respond to queries, and resolve any discrepancies. We ensure that your business is well-prepared and compliant with all GST requirements.

GST Training and Workshops

Empower your team with our GST training and workshops. We offer customized training sessions that cover the fundamentals of GST, compliance requirements, and best practices. Equip your staff with the knowledge they need to manage GST effectively within your organization.

GST Appeals, Refund Claims and Litigations

Are you eligible for a GST refund? Our experts will assist you in identifying and filing for GST refunds, ensuring that you receive the amounts owed to you promptly. We handle all aspects of the refund process, from documentation to follow-up with tax authorities.

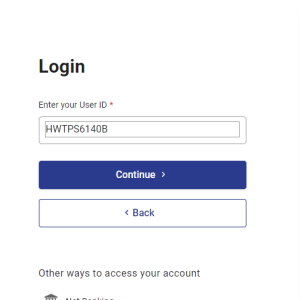

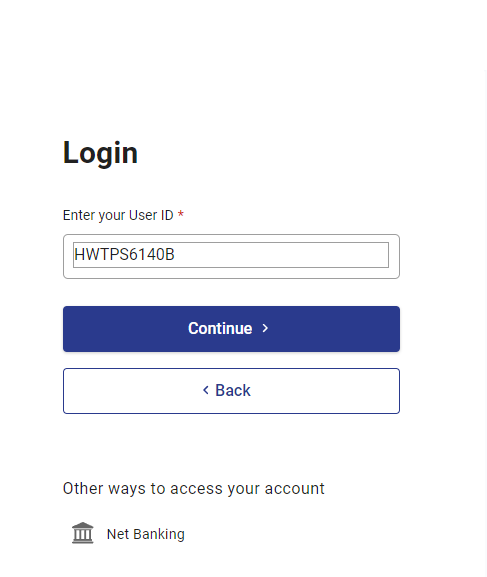

Filling of GST Return

Filing GST returns is essential for compliance under the GST regime. Here’s a summary:

Types of GST Returns: Various returns cater to different taxpayer needs, including GSTR-1 for outward supplies, GSTR-3B for monthly summaries, and GSTR-9 for annual summaries.

Filing Process: Taxpayers log in to the GST portal, select the appropriate return form, fill in details accurately, and submit electronically.

Due Dates: Due dates vary by return type and taxpayer category, with GSTR-1 typically due on the 11th of the following month.

Consequences of Non-Filing: Failure to file or delays can lead to penalties, loss of input tax credit, and compliance issues.

Assistance and Support: Taxpayers can seek help from professionals or use the GST helpdesk, staying updated through regular notifications.

Importance of Accuracy: Accuracy is crucial to avoid audits and ensure smooth processes. Proper record-keeping aids in compliance.

Adhering to procedures and deadlines enables taxpayers to fulfill their GST obligations efficiently,

contributing to a transparent tax system.

Amrally GSTR -4

GSTR-4 is a quarterly return for businesses under the Composition Scheme. It summarizes their tax liabilities and payments, providing a simplified filing option

Monthly Try

“Monthly Try” likely refers to attempting something new every month. It’s a personal development strategy to explore various activities or goals regularly, fostering growth and discovery.

Registration Quick Links

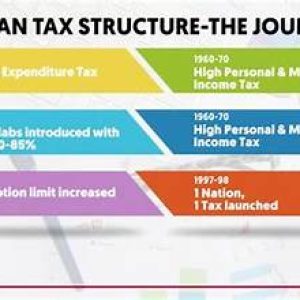

GST LAW

Act, Rule, Amendment, Notifications, etc. relating to GST Law issued by Central and/or State Government may be accessed from the websites of Centre and State respectively through the links provided below.

GST Law* : GST Law comprising (i) Central Goods and Services Tax Act, 2017 including Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017, (ii) State Goods and Services Tax Act, 2017 as notified by respective States, (iii) Union Territory Goods and Services Tax Act, 2017, (iv) Integrated Goods and Services Tax Act, 2017 including Integrated Goods and Services Tax (Extension to Jammu and Kashmir Act, 2017), (v) Goods and Services Tax (Compensation to States) Act, 2017 (hereinafter referred as CGST, SGST, UTGST, IGST and CESS respectively at the GST portal) and (vi) Rules, Notifications, Amendments and Circulars issued under the respective Acts.

Why Choose Us?

- Expertise: Our team consists of qualified professionals with extensive experience in GST compliance and advisory services.

- Tailored Solutions: We understand that every business is unique. Our services are customized to meet your specific needs and challenges.

- Timely Support: We prioritize timely communication and support, ensuring that you never miss a deadline.

- Proactive Approach: We stay ahead of the curve by keeping up with the latest GST developments, allowing us to provide proactive advice and solutions.

Free Estimation

Request A Quote

“Seeking professional accounting? Let us handle your financial needs with precision and expertise. Request a quote today for tailored accounting services.